Welcome to 10XTS Insights by me, Michael Hiles. I am the CEO and founder of 10XTS where I lead the team of merry hooligans working to solve awesome technology problems. If you’re getting this, we’ve directly interacted somehow in the past, met at a conference, connected on LinkedIn, a friend, colleague, or otherwise connected.

I send out the free 10XTS Insights email every weekday to friends and associates tracking what we’re doing in blockchain, fintech, and regtech. BTW this article does not constitute legal, financial, or any other professional advice and is not intended to be relied upon as such.

Wowzers, 4:30pm.

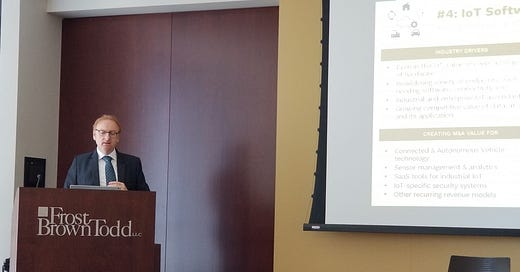

Several of the 10XTS team hit the M&A bootcamp this morning with Rob Griggs & William Hill of Corum Group.

Corum is the largest sell-side investment bank for software & technology. A whole bunch of tombstones doing single digit million to multi-billion sales.

Rob was the founder of Authorware, which became Macromedia where they acquired a bunch of companies and sold to Adobe for a few billion.

Always good to have investment bankers like that take a liking to you I suppose.

Seriously, we are delighted for any opportunity to learn from these OG mentors. Shapes our entire approach to 10XTS when we are very clear about the next 2-3 years.

Got confirmation about my observations of a ripple in the VC universe — where it seems a lot of GPs are “between funds”. The WeWork effect is real - and family offices/PE are indeed playing a smart, long game now that doesn’t involve outsourcing deal flow, due diligence, etc... They’re still looking to write bigger checks at a strategic level, but not necessarily to VC funds like it once was.

Not sure how that will play out in the long haul — but I want to be spending my time appropriately with the right clients & investors (who happen to be one in the same for us).

We also learned 10XTS and XDEX presses several of Corum’s “Top 10 Disruptive Trends” buttons which highlights wholesale strategic technology segments in high demand (and will be for a while). Even just one of these trends represents billions (maybe trillions) of dollars in capital. Crossing over multiple lanes here is perceived as exponential value.

I also like the fact current trending on fintech alone is 24x EBITDA. I know where we need to be by the end of next year… or Q2 2021 — we’ll see how it goes ;)

The other big knowledge drop was how much powder is in both strategic and private equity transactions.

Trillions.

Literally.

All of it is green light go, stomp on the pedal for us - and I am especially grateful to be under these guy’s wing at this stage. It helps me understand the expectations, process, etc… in advance.

Okay, Friday in effect.

Michael Hiles, CEO

Are you reading this on the web somewhere or did you get it forwarded from a friend? Subscribe now and get it sent directly to your email in-box!